In this article we will walk through how Canadian customers can apply and manage tax codes in MakersHub, including:

How tax codes are assigned and trained

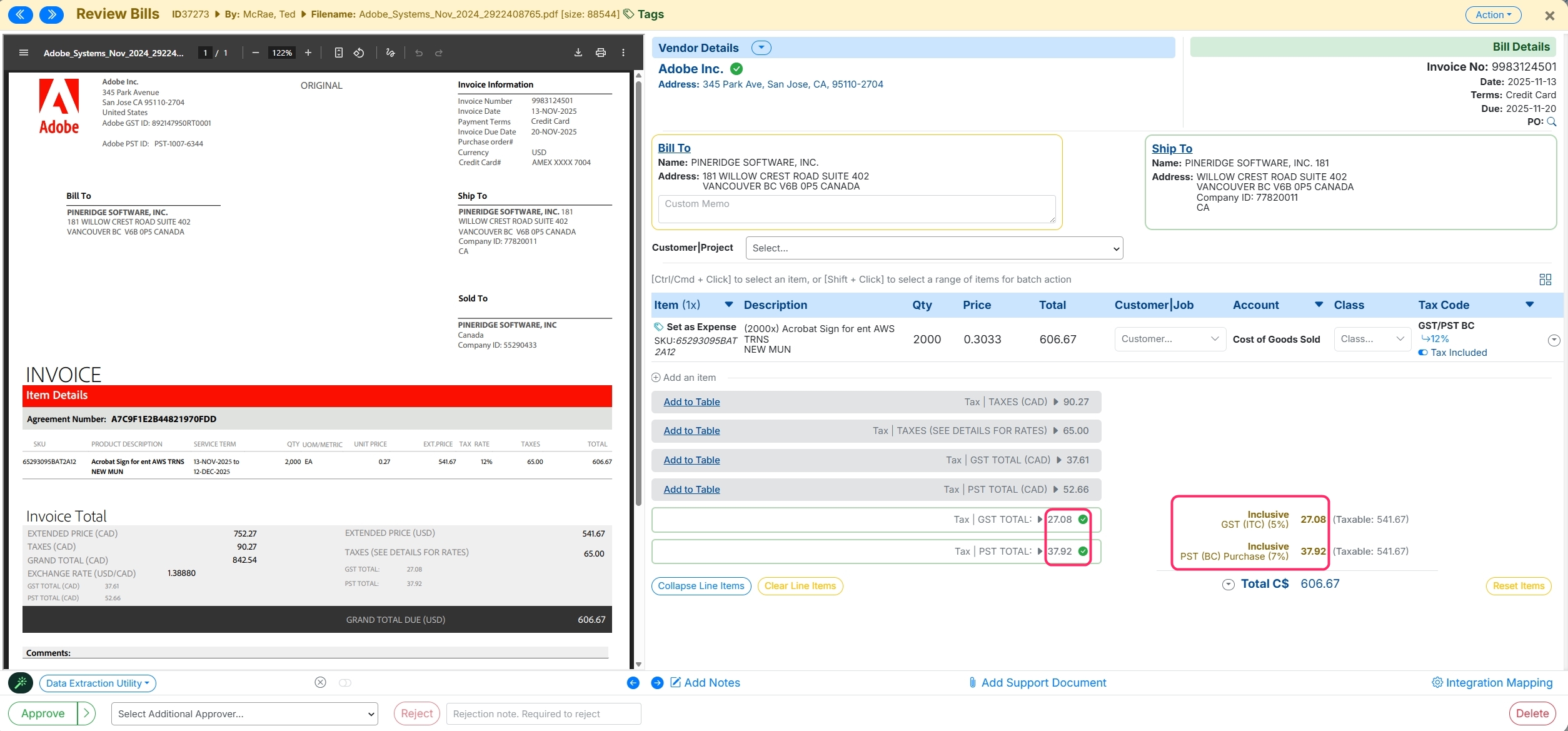

How to indicate whether prices include tax

How to reconcile the tax on the bill with the tax in MakersHub and how to address any discrepancies

Before getting started, reach out to your sales or support contact to ensure that the Canadian tax module is enabled for your account.

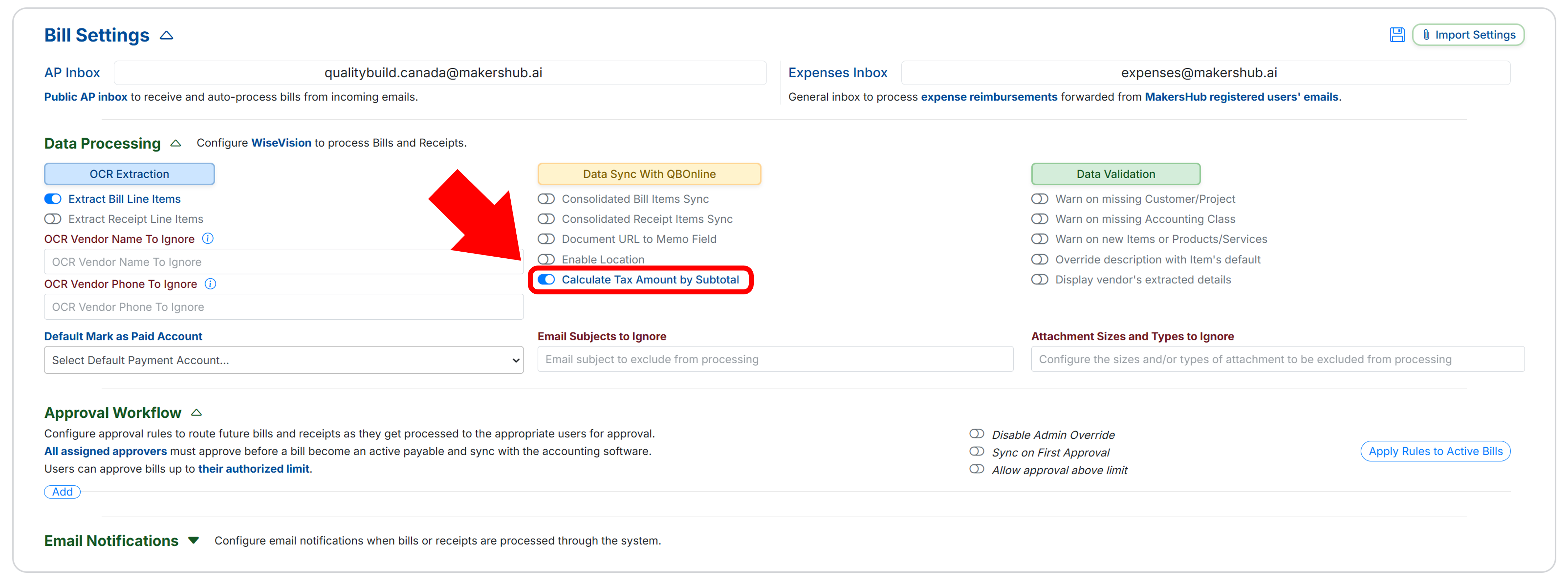

If You Use QuickBooks

You will want to navigate to Bill Settings>Data Processing and toggle on Calculate Tax Amount by Subtotal. This will have MakersHub replicate the way QuickBooks calculates taxes based on the subtotal of the line items as opposed to each line item, avoiding rounding discrepancies between MakersHub and QuickBooks.

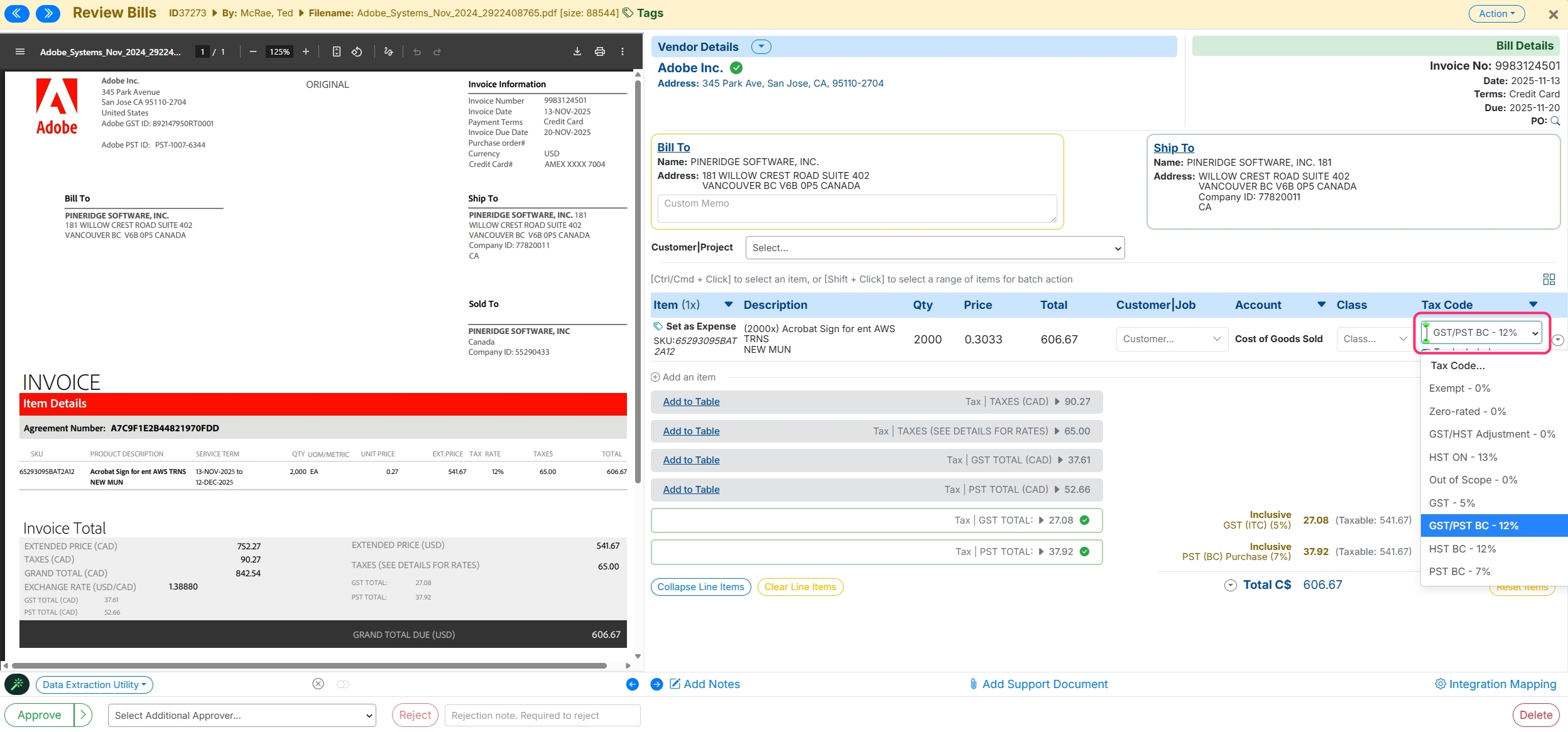

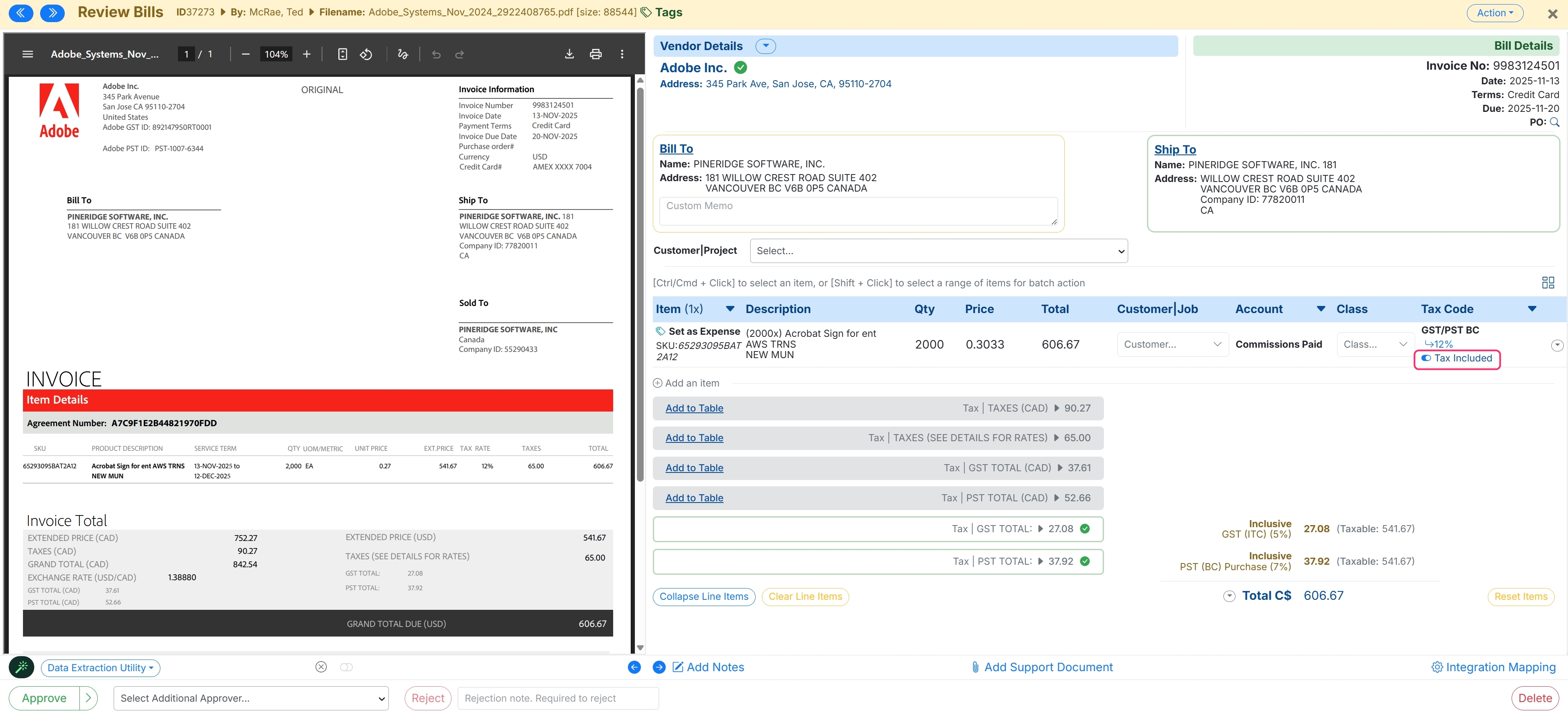

Getting Started: Assigning Tax Codes

When MakersHub extracts line items, the first step is to assign tax codes at the line level. To do this, click into the Tax Code field on a bill line item and select the appropriate tax code from the drop down. If the bill contains multiple line items and you want to apply the same tax code to all of them, click the down arrow to the right of the Tax Code column and apply it to the entire bill.

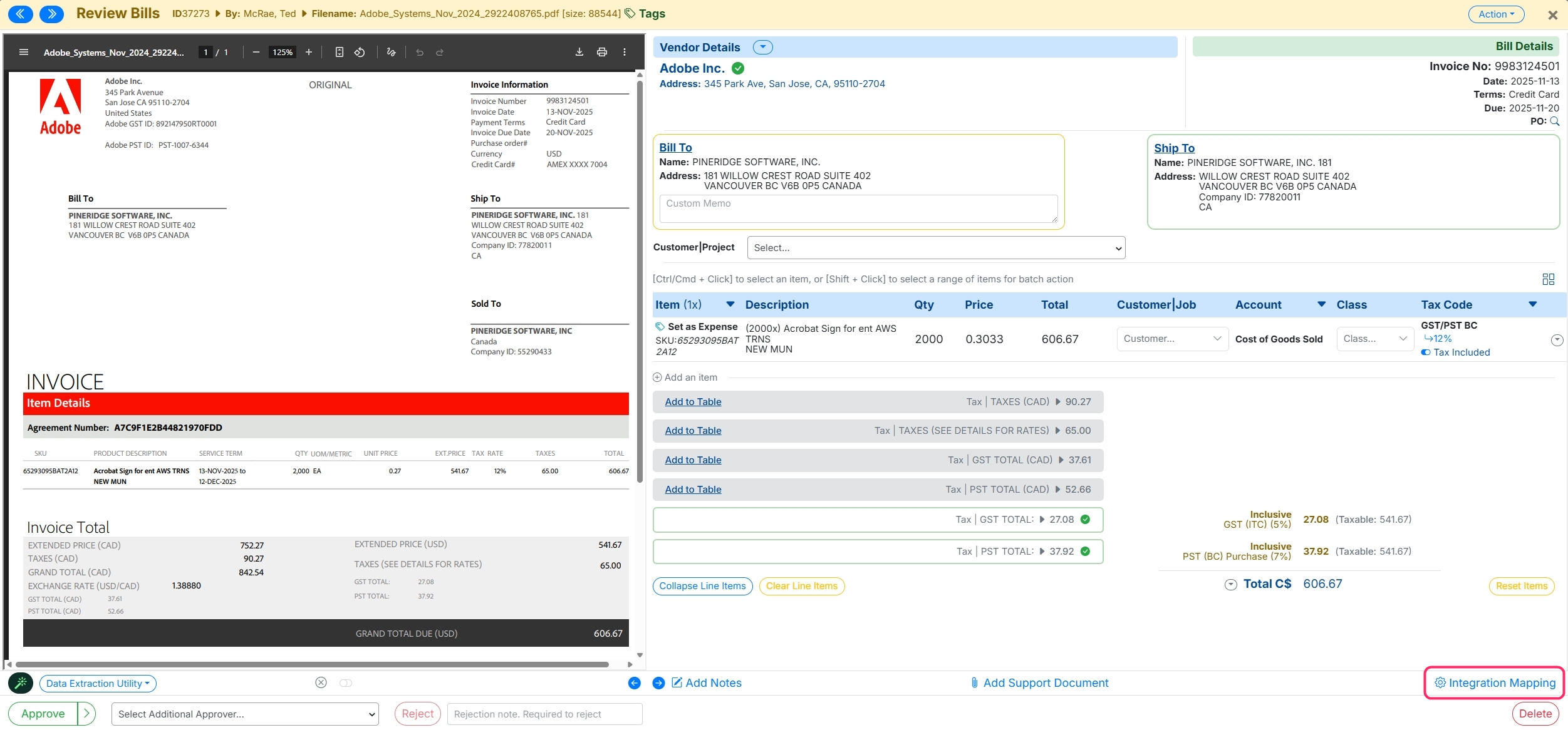

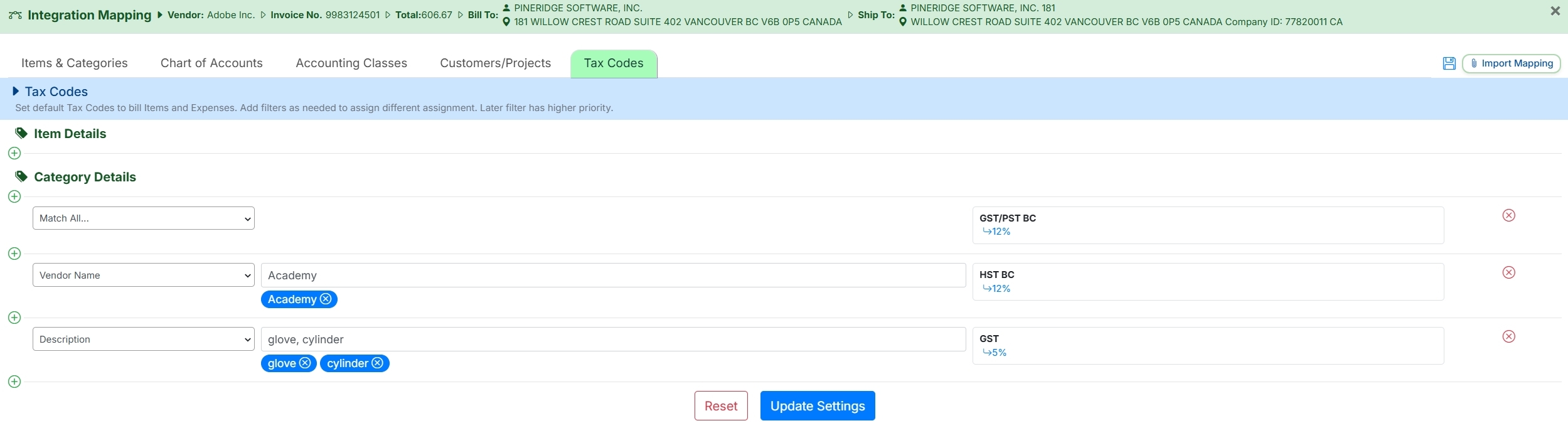

You can train MakersHub to automatically assign tax codes based on criteria such as vendor name, item number, or description by clicking on Integration Mapping in the bottom right of the bill.

Within integration mapping, navigate to the Tax Codes Tab and here you can instruct MakersHub on how to assign tax codes for Items or Expenses(Categories). In our example below:

We are assigning All line items to GST/PST

Unless MakersHub finds the vendor “Academy”. In which case the line items are assigned to HST

Unless any line item contains the words “glove” or “cylinder” in the description. These are coded to GST.

Order of Operations

Please note that the lower the rule on the Integration mapping list the higher the priority. You will want to keep general coding such as “Vendor Name” higher on the list than “description” to allow for “description” to override the “vendor name” rule.

Is Tax Already Included in the Line Items?

Now that we’ve assigned the tax code, the next step is to determine whether tax is already included in the line item on the bill. When reviewing the bill, there are two scenarios that may occur:

The tax is shown separately at the bottom of the bill and NOT included in the line item price

The tax is included in the price of the line item

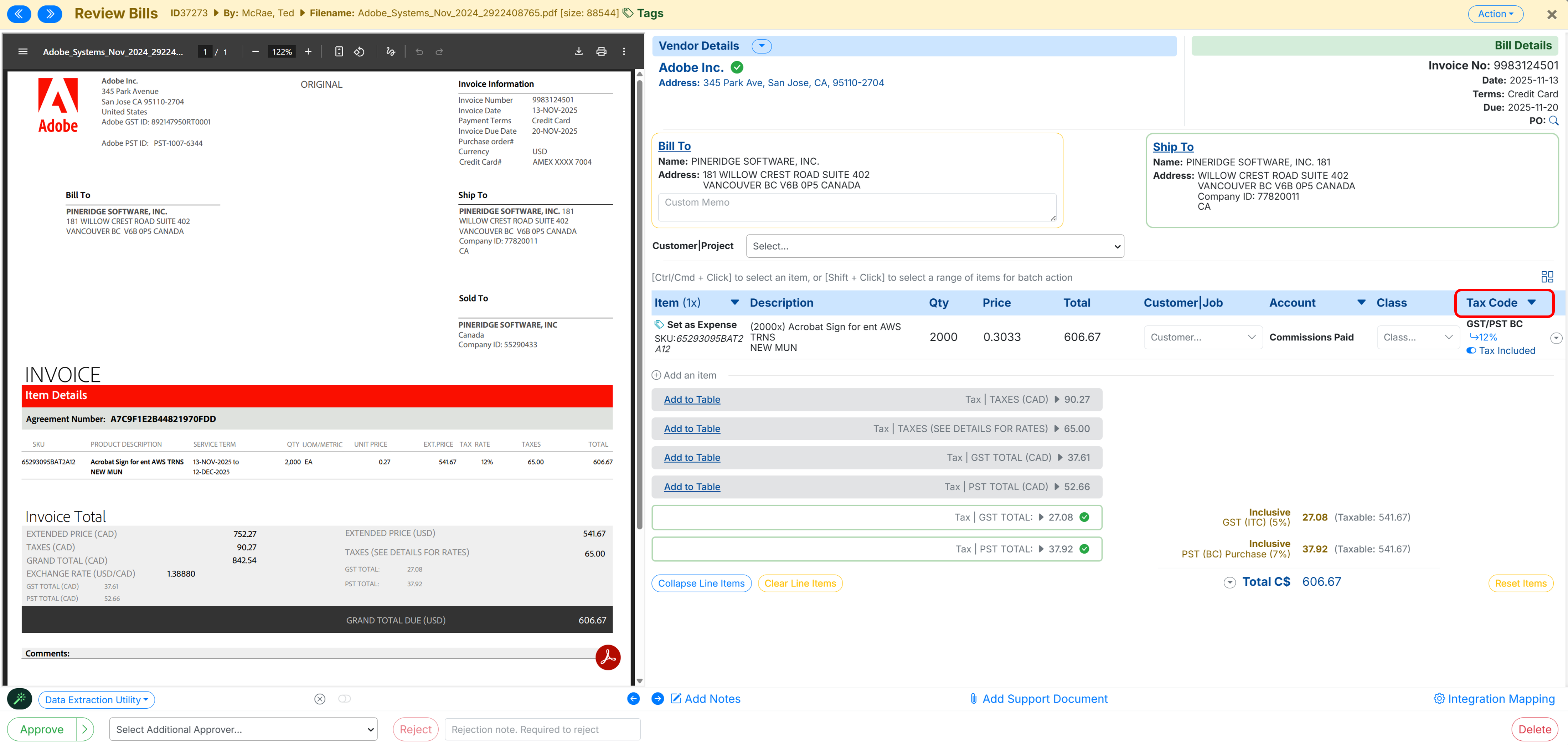

By default, MakersHub assumes that tax is NOT included. In scenarios where tax is included in the price of the item, select Tax Included on the bill line to properly break out the tax amount and total.

To train MakersHub to always include tax at the line level for this vendor, click the down arrow to the right of Tax Code.

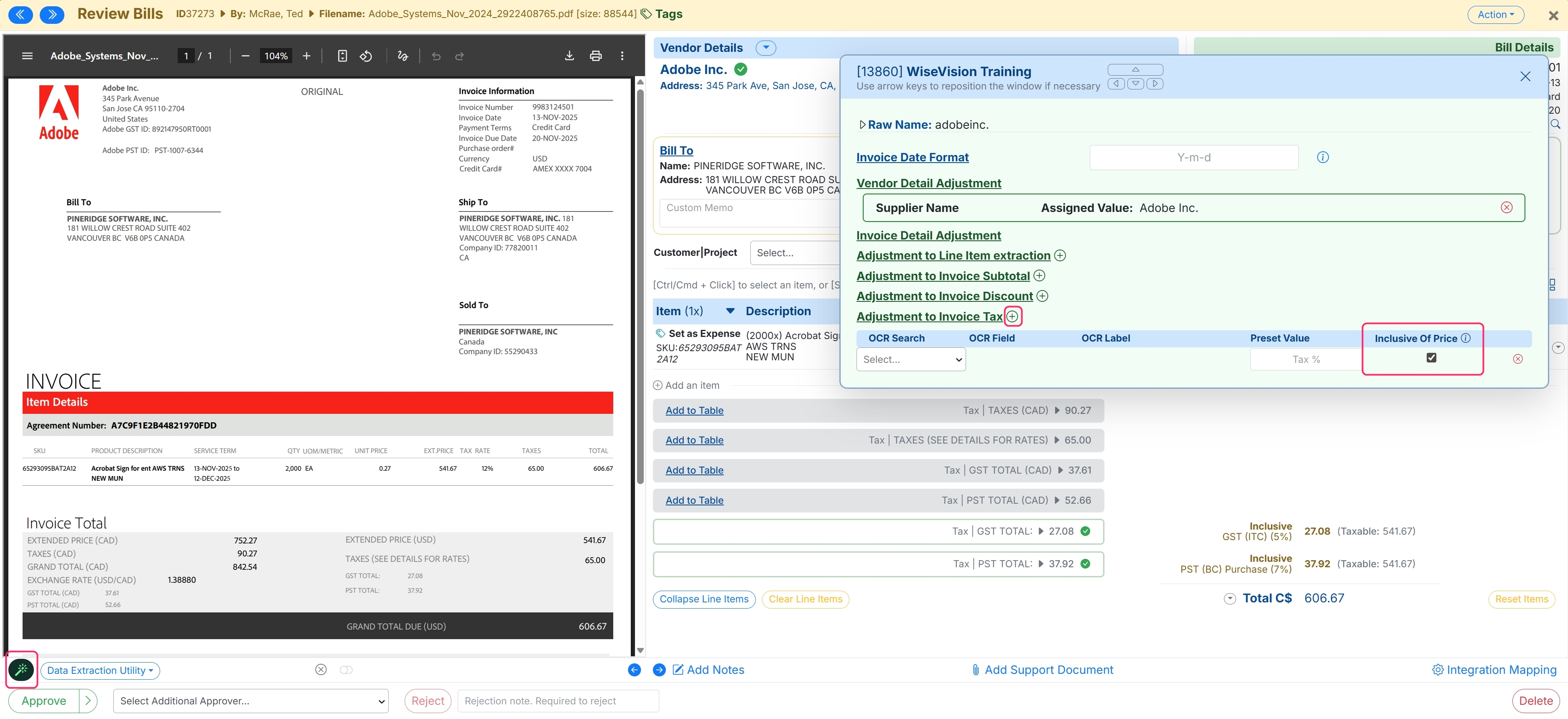

This will train MakersHub that for all bills from this vendor, the tax is included in the line item detail. To view or make edits to the training, click the Wand Icon in the bottom left and you will see the training under Adjustment to Invoice Tax. On the right hand side, you will see a check box that says Inclusive of Price. Should you need to make changes, you can always toggle this on/off.

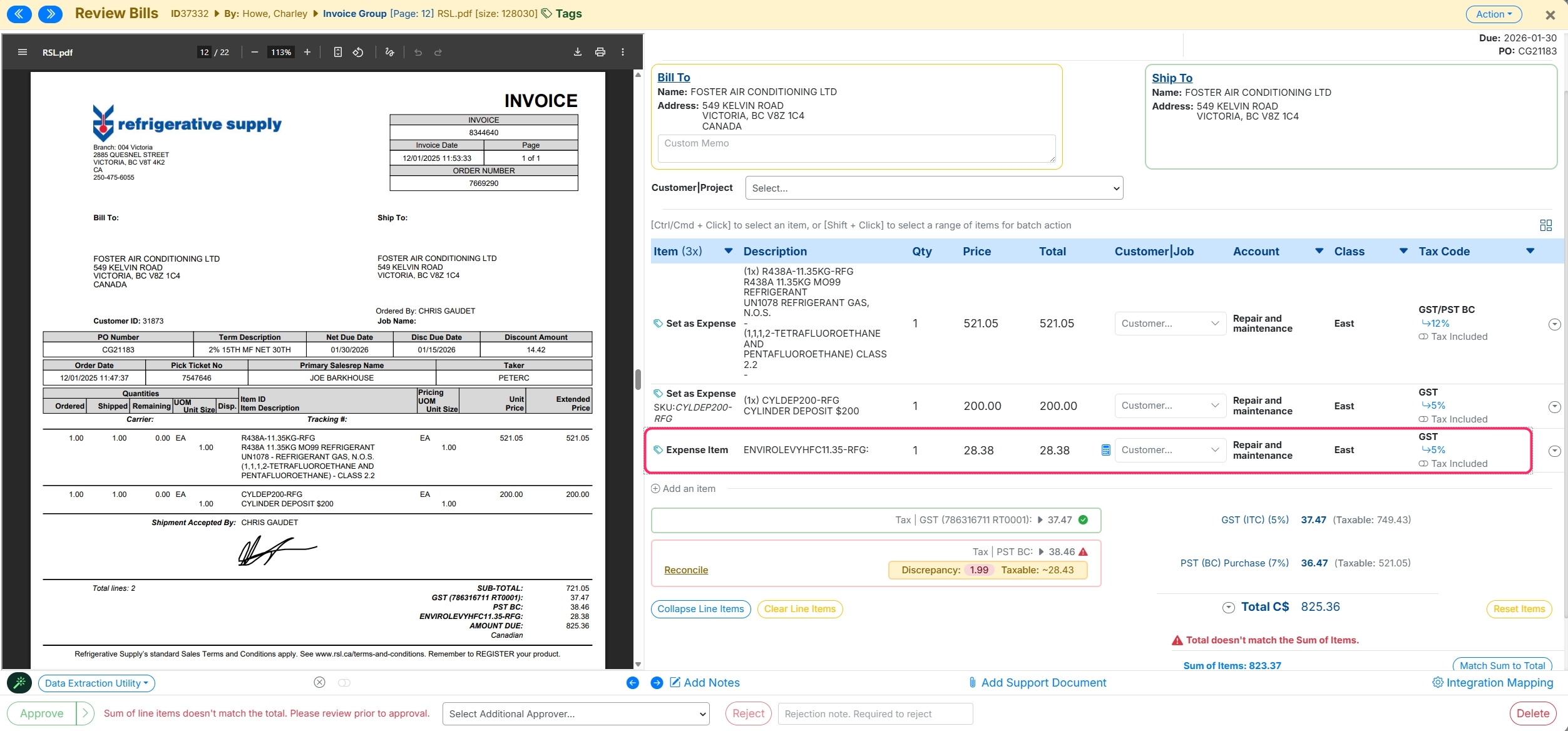

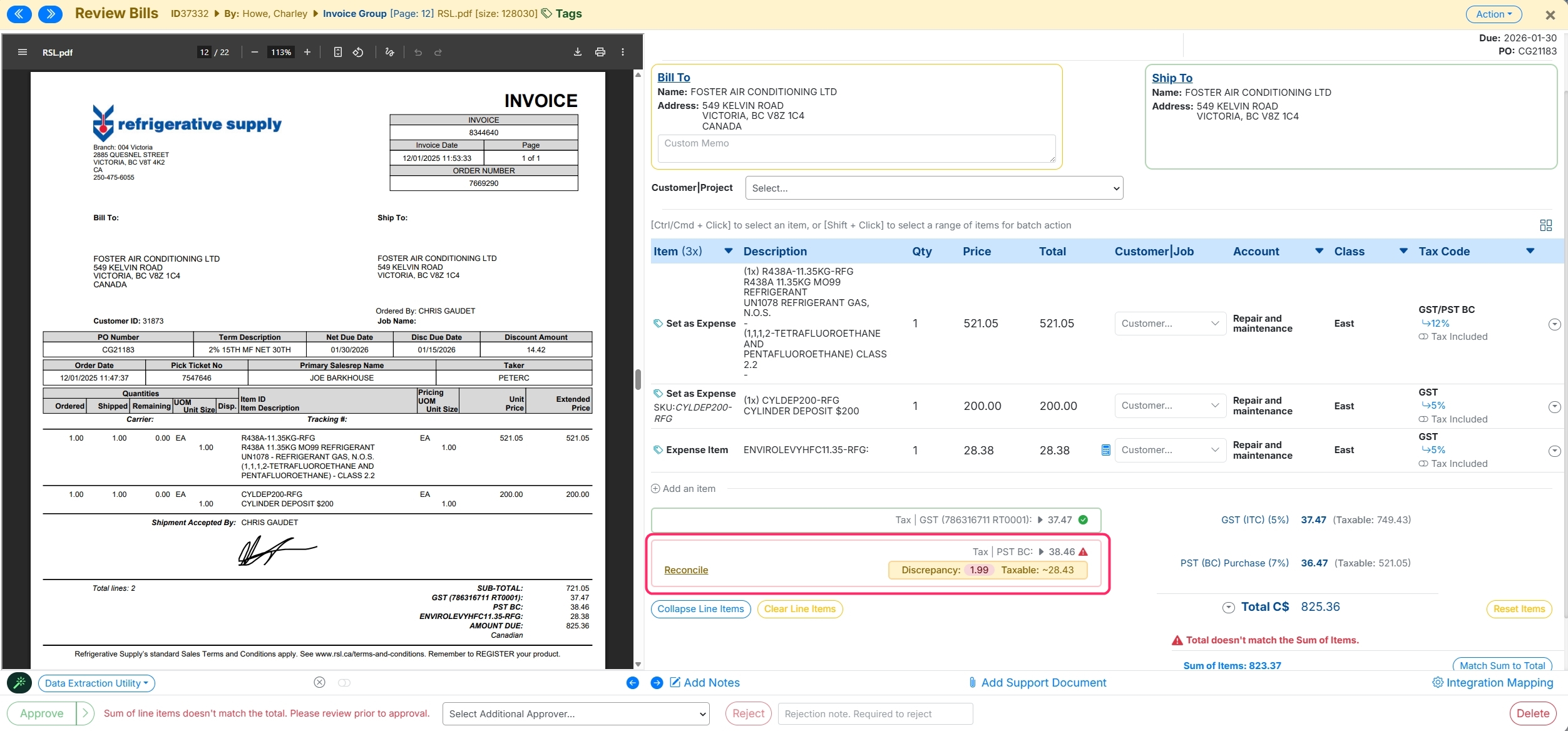

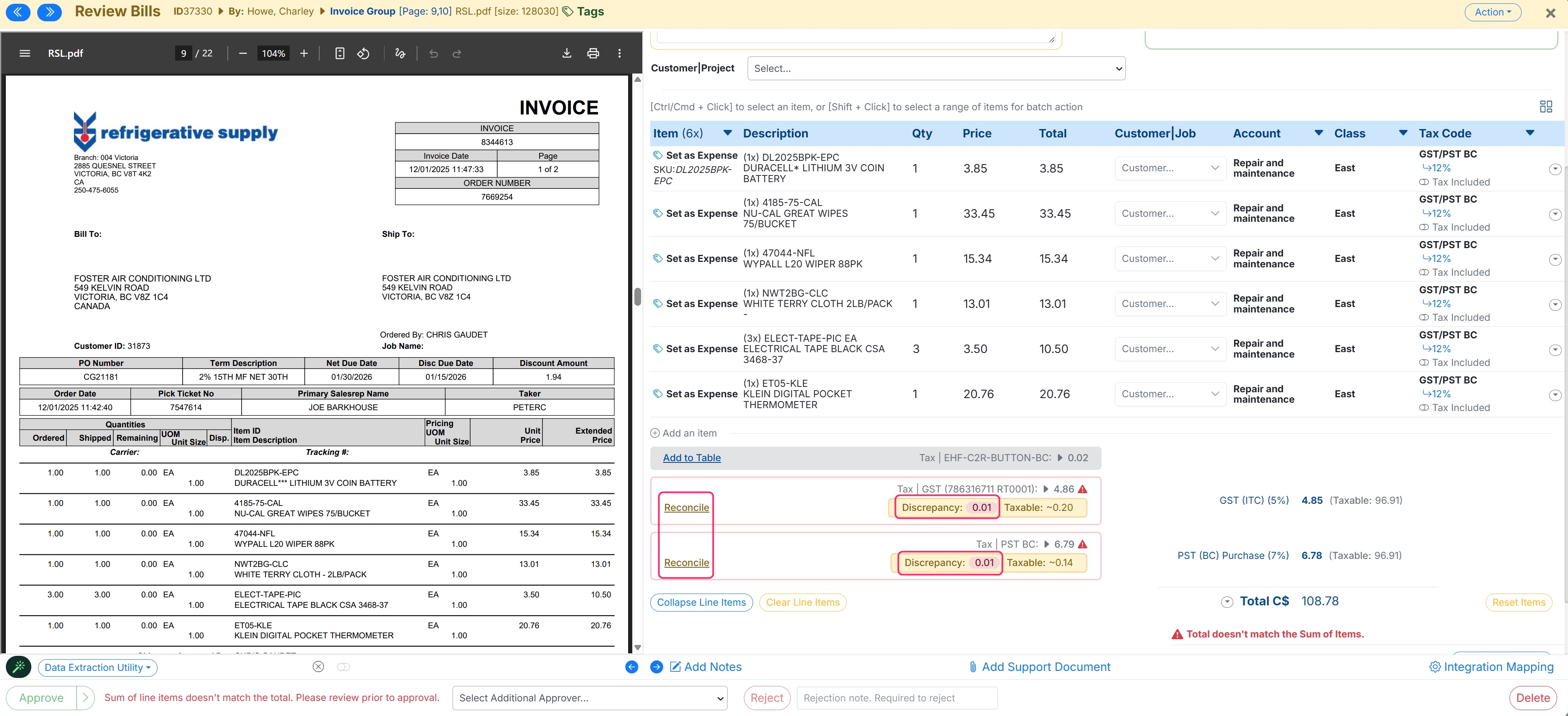

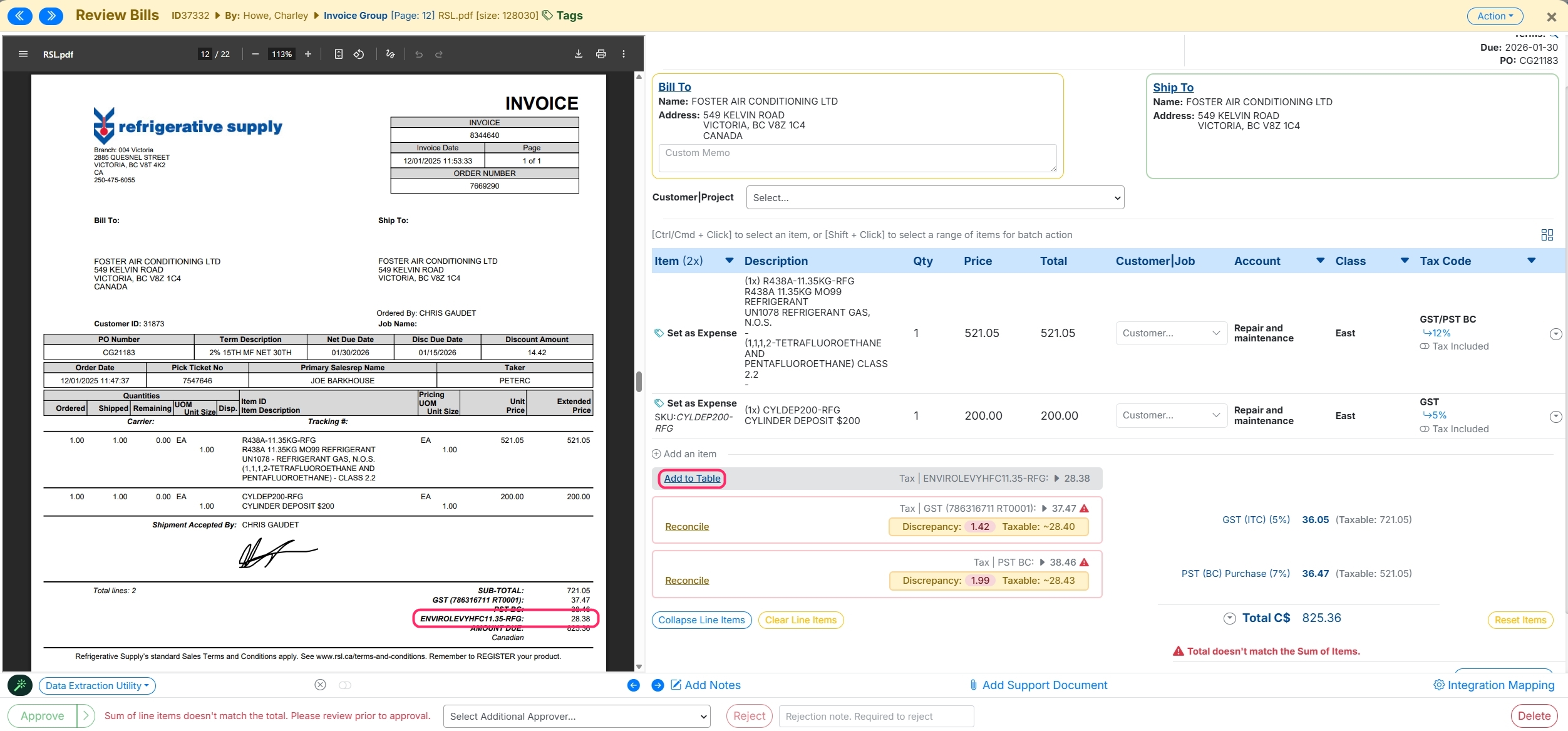

Discrepancies Between the Tax on the Bill and the Calculated Tax

Once a tax code is chosen at line level MakersHub will run the calculations on the tax amounts (GST/PST) and compare them to the tax amounts shown on the bill. If the amounts match, a checkmark will appear next to the tax line to indicate the values align.

If a discrepancy between the amount calculated from the line items and the amount extracted from the bill, we will flag the relevant tax code. The flag will show the variance and allow you to make changes, if necessary, to reconcile the amounts.

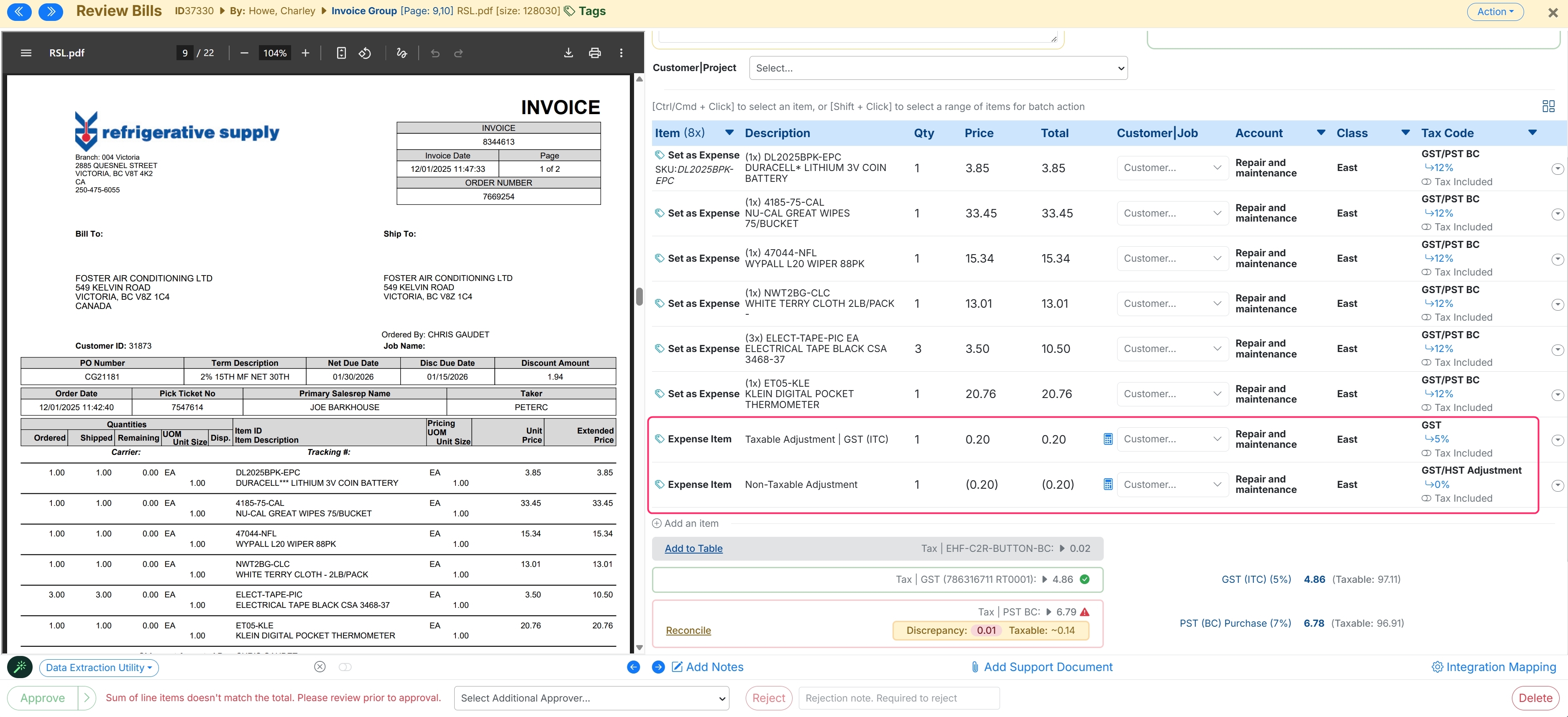

Rounding Errors

In some cases, vendor rounding can cause a $0.01 discrepancy between the calculated and displayed tax amounts. To resolve this, click the Reconcile Button next to the affected tax line.

This will post two adjustment lines to the bill to true up to the listed tax amount:

One taxable line to account for the discrepancy.

Another non-taxable line to offset that amount and ensure the bill total remains correct (see below an adjustment made to reconcile the GST).

Taxable Item Included in Total Summary

If an item is missing from the bill’s line items—for example, a taxable fee listed in the summary section—use the Add to Table button to add the field to the line-item details.

The line item has been moved into the body of the bill and is now treated as taxable.